Forecast Lake Tahoe | Truckee Real Estate 2023

Effective November 3, 2022, the Fed raised interest rates once again to battle inflation. This is the fourth consecutive .75 point hike in 2022.

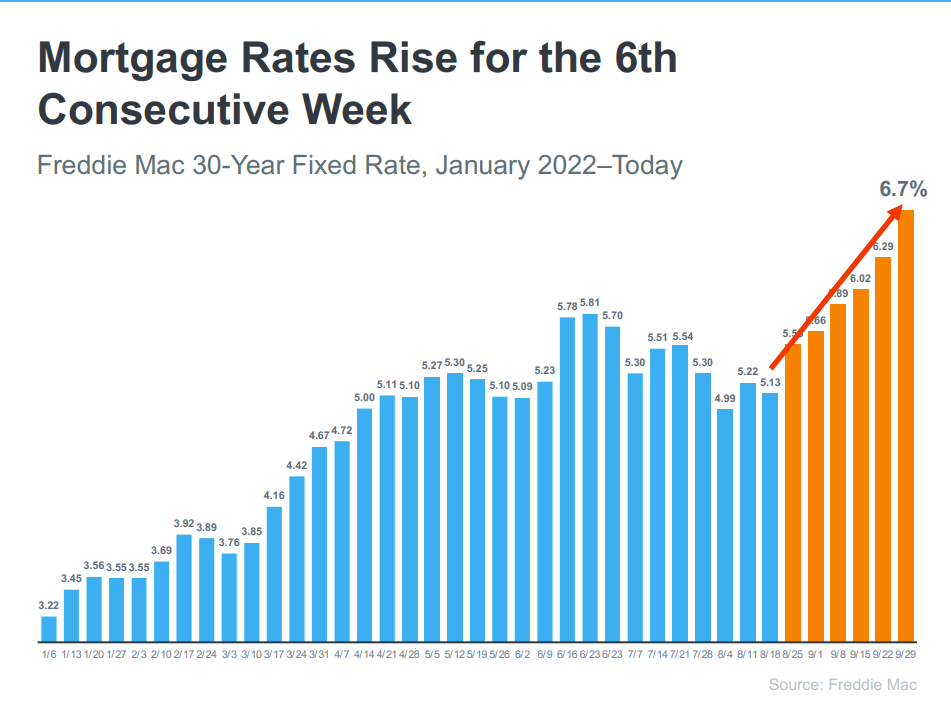

As of today, interest rates are at about 7.32% and this has definitely slowed down the real estate market. The below graph from October shows how quickly rates have been rising during 2022.

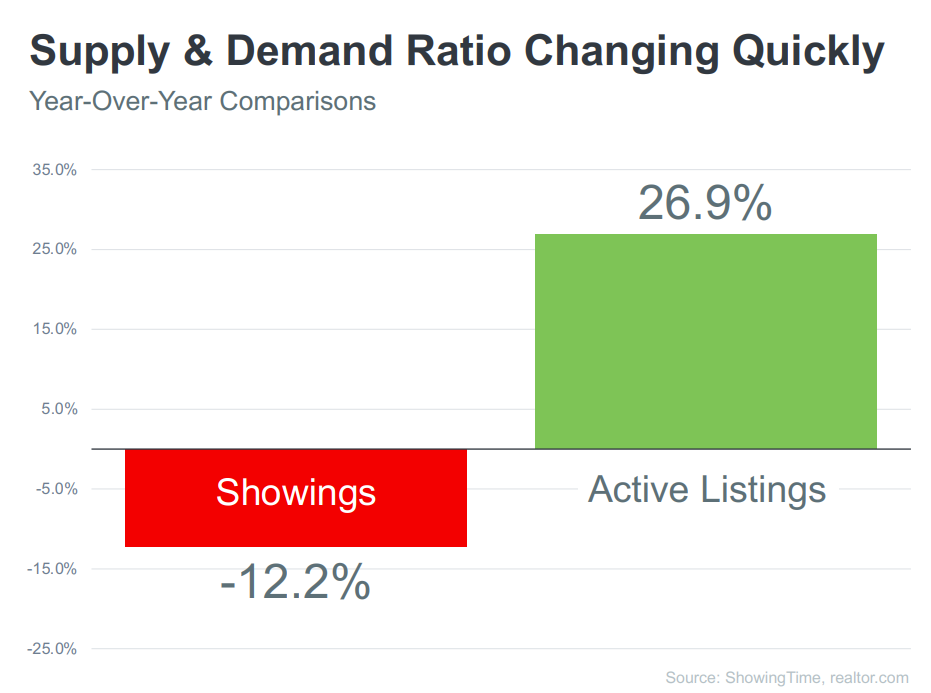

While pendings and closings are down, not everyone believes that home values will adjust down. The graph below compares current activity to last year. However, last year was an unusually active market. Still, we are seeing less activity, which is allowing inventory to return to normal levels.

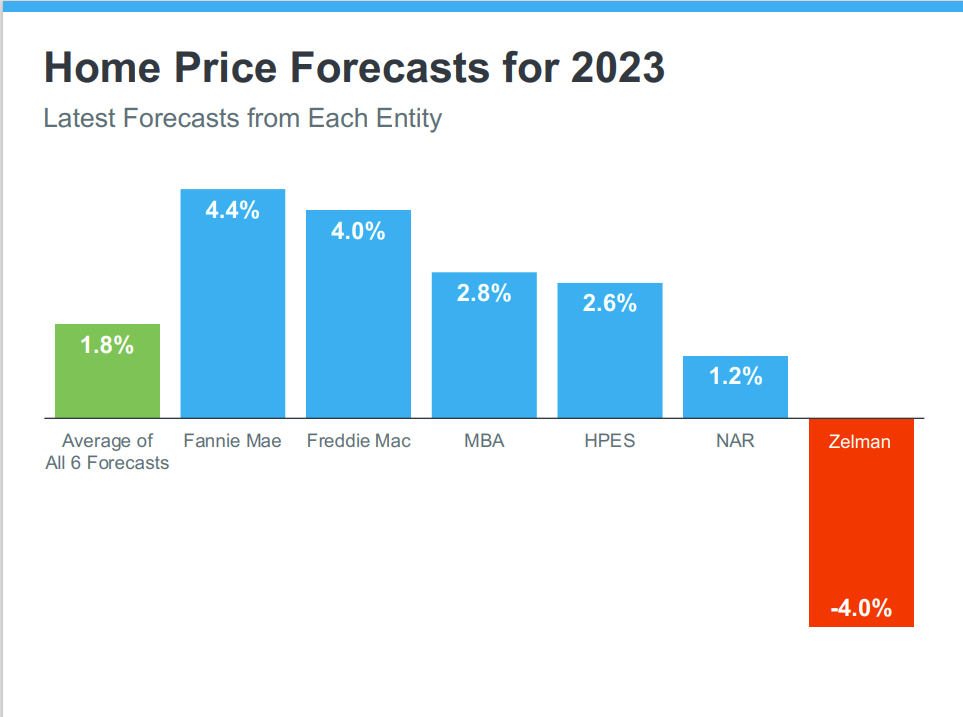

Experts are viewing how fix to the stalling market differently. For example Mark Fleming, Chief Economist at First American said: "While the markets considered overvalued may need to adjust to the not-so-new reality of higher mortgage rates, housing market fundamentals still support a moderation of annualized house price appreciation, rather than a sharp decline."

It may be just a matter of time before buyers accept the new reality of higher interest rates.

At the other end, George Ratiu, Senior Economist at Realtor.com stated: "With sales of new and existing homes declining for over half a year...demand is cooling due to high borrowing costs, incomes falling behind inflation and the still-limited supply pipeline, it is becoming increasingly clear that prices have to decline to restore market liquidity and balance."

Many economists view the current real estate market completely different from what happened in 2008. There are not alot of foreclosures and units flooding the market. The issue is simply borrowing costs have become more expensive.

"We’re not at risk of a collapse today in the financial system like we were before. It’s true - housing may be a little frothy. So housing prices may come down or they may plateau but not to the extent it happened." John Paulson, Billionaire Hedge Fund Manager Who Called 2008 Crash.

It is easy to fall prey to misinformation about real estate bubbles, but whether interest rates come down or people grow accustomed to the new normal, buyers still want to buy real estate.

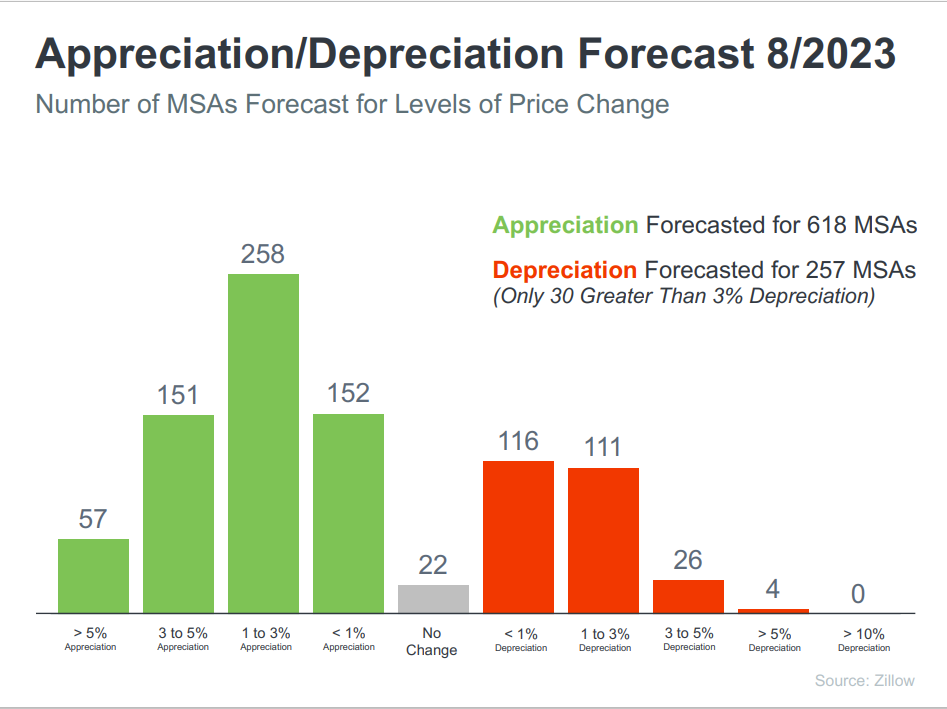

The demand remains for housing. The out of control rise of home prices in 2021 has been calmed. Overall, most forecasters still see home prices continue to rise, albeit, more moderately.

"When the economic uncertainty dust settles, those buyers and sellers who were on the sideline will jump back in the housing game. Demographic trends support elevated purchase demand in the years to come, so it’s a question of when, not if, for the housing market." Mark Fleming - Chief Economist - First American

You can read the full report here.

Contact me today for a free market analysis of your home or for more information about the Lake Tahoe and Truckee real estate market.

Market Stats

Market Stats Listing Watch

Listing Watch My Home Valuation

My Home Valuation