2022 Year-End Lakefront Market Report Lake Tahoe

We are kicking off the 2023 New Year with a record breaking snow level that has everyone thinking about skiing at Lake Tahoe. The last two weeks of January promise clear skies and epic skiing and boarding!

As we close the books on sales activity for 2022, we experienced year over year sales decreases, but with the median price still up in most areas.

Lake Tahoe | Truckee 2022 Sales Report

The median sale price for homes in the Tahoe Sierra Board of Realtors showed a 5% increase, even while sales activity has slowed. We began 2022 with sales activity that matched 2021, but with the FED constantly raising interest rates in the 2nd half of the year, the market definitely cooled.

However, inventory is still only at a few month’s supply and sellers are not rushing to reduce prices. Inventory would need to be at the 6 month number to change a seller’s mind that we are in a buyer’s market.

In 2022, there were 1,299 transactions with a median price of $1,075,000. The median price was up 7%, so even while the year saw fewer transactions than the prior year, higher prices resulted in higher sales volume.

More than 54% of homes sold in Lake Tahoe and Truckee were over $1 million and almost one quarter of the sales were over $2 million. Home sales across the region were down 19% compared to 2021.

Lakefront Market Report Year-End 2022

The lakefront market experienced deeper year over year total sales decreases, with a slight increase in the days on market required to sell. Average sold prices were still higher and currently, there are only 23 lakefront listings available across the East, North and West shores of Lake Tahoe

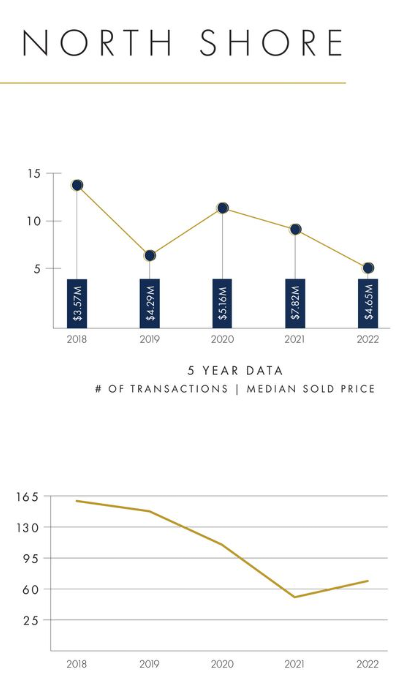

North Shore Lakefronts

The average sold price for 2022 was at $8.45 million, compared to $7.20 million for 2021, showing a 17% increase. While 9 North shore lakefronts sold in 2021, only 5 sold in 2022 at a 44% decrease in sales activity. The list to sale price held steady at 96%, but overall dollar volume of sales was down 35%.

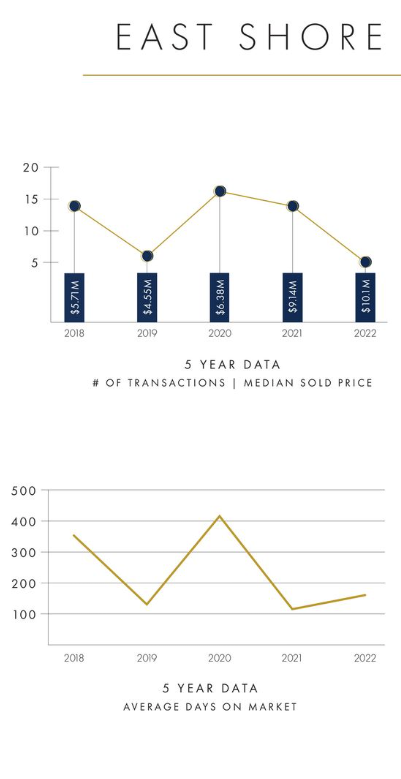

East Shore Lakefronts

The median sale price for 2022 was actually 11% higher year over year at $10.1 million. However, the needed days on market required to sell jumped a whopping 39% from 114 days in 2021 to 158 in 2022. While 14 East shore lakefronts sold in 2021, only 5 sold in 2022 at a 64% decrease in sales activity. The list to sale price dropped 6%, and overall sales volume of East shore lakefronts was down 51%.

West Shore Lakefronts

The median sale price for West shore lakefronts came in at $7.9 million, compared to $7.6 million in 2021, an increase of 4%. The number of lakefronts sold dropped to 5 units, compared to 16 sales in 2021. The list to sale price dropped only 3% to 95% of asking price. Total dollar volume of West shore lakefronts sold was down 56%. The average days on market didn’t change much, from 93 days in 2021 to 101 days in 2022.

Incline Village | Crystal Bay Lakefronts

South Shore Lakefronts

The lastest inflation report came in lower for the sixth consecutive month. Markets are hoping that the FEDs aggressive rate hikes will back off in 2023. Stock markets rallied last week and the lakefront market seems to follow market highs.

There is still a strong demand for the reduced inventory, or available homes for sale. This could change after the ski season as everyone is currently focused on the powder.

Contact me today for more specific information on the local lakefront and real estate markets at Lake Tahoe.